Allowance for doubtful accounts (ADA) is a financial metric that estimates the value of rendered services or goods sold that you don’t expect to get paid for. Essentially, it’s a tool used in accrual accounting as a way of tracking bad debt and potentially uncollectible accounts up front with the end goal of maintaining more accurate financial statements.

But what is the allowance for doubtful accounts in application and how do companies calculate it?

Why Track Allowance for Doubtful Accounts?

Tracking ADA helps you maintain more accurate balance sheets. ADA is a type of contra asset account used to reduce your account receivable balance (“contra asset” referring to an asset account where the account balance is a credit balance). ADA is paired with bad debt expenses on your company’s balance sheet, meaning that when you fail to collect on an invoice, ADA is credited and bad debt expense is debited.

This is important due to one common and unfortunate business reality: When businesses extend credit to a company, they risk the potential of bad debt. In other words, companies don’t always pay what they owe. When a company fails to pay some or all of its debt, that sum should be accounted for in the balance sheet to create the most accurate snapshot possible of accounts receivable (A/R) and financial health overall.

The allowance for doubtful accounts helps CFOs and controllers better understand the true state of a company’s finances and make more accurate cash flow projects long-term via balance sheet forecasting. It can also be thought of as a risk assessment tool that gives finance teams a better idea of how future clients may perform with respect to paying their debts. In addition, tracking doubtful accounts is a requirement of financial regulations that accounting departments must adhere to such as the Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

How to Calculate Allowance for Doubtful Accounts

There are three primary ways for how to calculate bad debt expense or estimate doubtful accounts.

Method 1) Percent of Credit Sales / A/R

The first method involves examining credit sales (or the percentage of total collected A/R) and using historical collection data to determine how much of your invoices are written off, on average.

For example, if your company assesses A/R with a total value of $10,000,000 and your historical default rate is 2%, you can assume that $200,000 of your total will fall under doubtful accounts receivable. This method is simple and works best for companies with straightforward billing cycles that operate primarily on credit.

Method 2) Accounts Receivable Aging Report

The second method uses A/R aging reports to assign expected default rates to accounts receivable aging categories. The longer a given account remains in delinquency, the more likely it is that it’ll fall into doubtful accounts receivable.

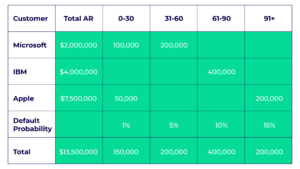

Here’s an example of how this might look:

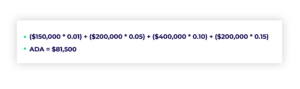

With this data, your ADA calculation would be this:

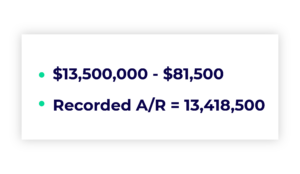

Then, subtract your ADA from your total A/R:

Method 3) Customer Risk Classification

The third method takes the most granular approach yet by assigning personalized default risk percentages or risk scores to each customer based on historical trends. This method is commonly used when client relationships span years and provide plenty of historical data for your business to pull from. If you want to assign a risk classification to a new customer you can calculate this based on the customer’s credit score, credit report from a credit bureau, and using historical payment and credit data from similar companies. The risk classification becomes more accurate based on the customer’s payment history.

Given that the default probability is unique to each company, this method offers the most accurate way of predicting ADA. The only way to do this accurately and at scale is with a software that uses AI and the appropriate algorithms to collect and analyze this data.

Streamline Your A/R Processes Today

Gaviti’s accounts receivable automation solution streamlines your A/R processes and helps your team work better. Make better credit decisions, lower DSO, and reconcile payments with near perfection. Schedule a demo to learn more.

Schedule a Product DemoHow Gaviti Streamlines Accounts Receivable to Proactively Reduce Doubtful Accounts

While no company expects to see substantial amounts of value lost through bad debt, it’s an important metric to stay on top of. Fortunately, ADA is relatively straightforward to track with the above methods. No particular method is truly better than another; what works for one business may be unsuitable for another.

But by streamlining and automating the A/R process with Gaviti’s autonomous invoice to cash accounts receivable platform, you can proactively guard against these doubtful accounts — which could become uncollectible accounts — in the first place.

Gaviti’s modules include:

- A/R Collections. Increase the potential for customers to engage and respond to your emails with a timely payment from fully personalized dunning workflows and unlimited segmentation. Escalate collections with the help of an AI autonomous process that loops in people as needed.

- A/R Analytics. Get more accurate predictive analytics, such as predicting future bad debts and risky customers based on past bad debts of customers with similar credit and payment histories with KPIs and reports updated in real time.

- Cash Application. Increase accuracy of cash application with AI-powered remittance matching and remittance portal automation. Accelerate payments by avoiding disputes and eliminating manual processes.

- Customer Self-Service Portal. Enable customers to pay 24/7 with multiple payment options and easily engage with your A/R team and solve common requests independently, mitigating the risk of unpaid or overdue invoices turning into doubtful accounts.

- Credit Management and Monitoring. De-riskify decision making with a quick and easy credit review, proactive flagging of risky clients and enforceable credit limits. Includes an AI copilot that gathers information and makes suggestions in terms of credit management and onboarding of new clients so that you can minimize the risk of bad debt.

- Dispute Management. Resolve and close disputes in under an hour with alerts with customizable workflows for tracking and routing and resolutions that are communicated in real-time. Discover trends in disputes, leveraging the information to resolve future disputes faster and reducing the likelihood of a doubtful account.

Want to get started streamlining and automating your accounts receivable with Gaviti’s autonomous invoice to cash accounts receivable platform? Get a demo today!