AI Powered Invoice to Cash

Make your accounts receivable predictable, and scalable. Reduce DSO, eliminate manual A/R work, and improve cash flow accuracy — without changing your ERP.

Schedule a Demo

Facilitating Billions of Dollars in Business Annually

Why Finance Leaders Choose Gaviti

-

95%

of reconciliation done before you start the workday

-

50%

decrease in late receivables

-

30%

decrease in DSO or more

The Complete Invoice-to-Cash Platform

Credit & Risk Management

Sell more to paying customers

- Thorough and quick credit checks

- Ongoing customer risk assessment generated from AI and credit reports

- Accelerate onboarding

Collections Automation

Lower DSO and late invoices

- Automated, personalized workflows that chase payments for you

- Reminders, escalations, follow-ups and tracking

- Task prioritization for your team

Customer Self-Service Portal

Hands-off customer payment portal

- Accept payments anytime day or night

- Offer zero-fee ACH and cheap credit card fees

- Reduce errors and fraud

- Autopay options

AI Cash Application

90% of payments matched before you start your day

- Automatically match payments to invoices with high accuracy

- Automated deduction management that includes code recognition

- Reduce unapplied cash, and close your books faster each month

- 100% accuracy from payment portal

Dispute Management

Get resolution faster and reduce write-offs

- Clear ownership

- Automated routing

- See trends and reduce future disputes long-term

AI Assistant

Your All-Knowing Assistant for Receivables Management

- Perfectly optimized dunning emails and workflows

- Ensure you have all the information you need to make the right credit decisions and set wise credit limits

- Have confidence that your remittance matching is accurate

- Build strong customer relationships with proactive insights

Analytics & Forecasting

See your entire receivable pipeline, track team performance, and forecast cash with confidence.

Read moreAI Powered Accounts Receivable

Gaviti AI is revolutionizing accounts receivable automation, transforming it into a proactive, intelligent, and highly efficient operation. It’s like having a Ph.D.-level intern working 24/7 but with capabilities that you can turn on and off as needed.

-

AI-Generated Workflows

Automate and optimize key A/R processes in minutes.

-

AI-Optimized Customer Communication

Send the right message at the right time consistently.

-

AI-Enhanced Customer Insights

See all customer behavior and risk trends.

Built on the most powerful AI engines, the future of A/R is here

Learn how AI can help you work more intelligentlyMake Payments and Communication Easier for Your Customers—And Your Team

Collect payments faster with the only B2B solution offering streamlined, professional receivable collection — without ACH fees. Gaviti’s Payer Portal gives your customers a single place to pay invoices, track credit requests, and resolve disputes, helping your team accelerate cash flow and avoid last-minute surprises.

With Gaviti, you get:

-

Zero-Fee ACH payments

for you and your customers

-

Lower credit card fees

saving you money on transactions

-

Autopay options

so customers never miss a payment

Our secure, professional interface builds customer confidence while giving them multiple payment options.

Learn more about the Gaviti Payer PortalWe Work With You - Not the Other Way Around

Build What You Need

Most platforms force you into their rigid workflows. At Gaviti, we adapt to your process, giving you:

-

Fully customizable workflows

Build the workflows you need to streamline your current

-

Unlimited personalization

Tailor outreach, escalation paths, and messaging

-

Custom dashboards & rep orts

See the exact data you need. Let every employee create their own dashboards and reports

-

Seamless integration

Works with any ERP or business system. Can connect to multiple systems simultaneously.

Don't change your process to fit the software—let the software mold to you.

Learn More About Product FlexibilityWe have 1 Goal: Get your cash into the bank faster

See what happens when you become a Gaviti customer:

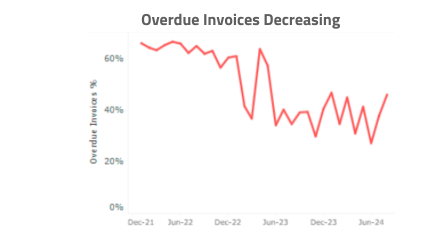

- Significant decrease in late invoices

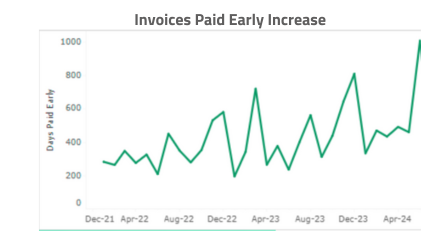

- Significant increase in early payments

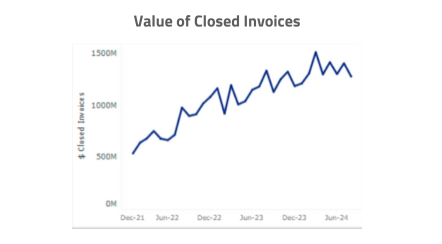

- Increase in closed invoice value