Do you want to optimize your accounts receivable collections processes? You first need to understand where you’re already succeeding and, perhaps more importantly, where your processes are lacking. This understanding is what’s important to track AR key performance indicators (KPI).

One of the most signficant KPIs to track is the collections effectiveness index (CEI). Here’s what you need to know to calculate the collection efficiency KPI and why it’s essential for your business.

What Is the Collections Effectiveness Index?

The collections effectiveness index, or collection efficiency ratio, is a measure of how well your accounts receivable department collects on invoices. It’s essentially a way to determine the effectiveness of your collections team.

CEI is calculated as a percentage. The higher the percentage, the better your AR team is collecting on invoices.

Collection Efficiency Ratio Formula

Before you grab the calculator, there are a few important terms you should understand to calculate your collections effectiveness index:

- Beginning receivables – The dollar amount of open receivables that you end and start the month. For example, if a client ends the month with total receivables of $5 million, the next month begins with the same amount.

- Ending current receivables – Any open receivables that aren’t overdue.

- Ending total receivables – All open receivables at the end of the month, including current and overdue receivables.

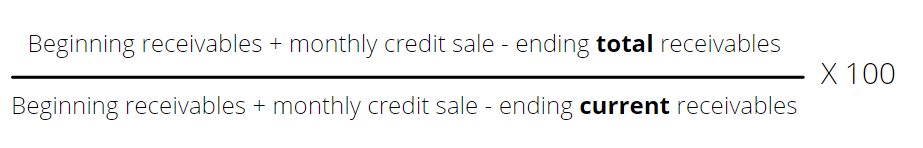

Once you find the values for each of these terms, you’re ready to calculate the collection efficiency ratio:

If your staff receives funds for every invoice during a billing period, your CEI would be 100%. A CEI around 80% or higher is considered outstanding, while anything around 50% or lower indicates that you need to work on creating more effective collections processes.

Want to improve your DSO?

Download this eBook to understand how to enhance your collections process with automation

Download NowThe Importance of Collections Effectiveness Index

As with most collections-based KPIs, calculating the effectiveness of your collections index regularly will give you a clearer idea of your team’s performance and how well your company can retrieve money on invoices.

If your CEI is poor, it means you’re leaving money on the table each month, which hurts your overall cash flow. Perhaps it’s time to take another look at your collections processes. On the other hand, if you have a strong CEI, it means your collections team is highly effective and your processes are working.

For even more visibility into collections performance, calculate your CEI along with other KPI like days deductible outstanding (DDO). DDO measures your company’s ability to resolve deductions from customer disputes. It’s great if your CEI is 100%, but if you have many deductions every month, you’re still not going to have the cashflow you need to succeed. The more AR performance indicators you calculate, the better you’ll understand the effectiveness of your collection.

How To Improve Your Collections Effectiveness Index

The best way to optimize your collection percentages for accounts receivable is to stay on top of collections efforts. Give your team the tools they need to effectively manage and track invoices, as well as communicate with customers:

- Automate processes – Manual administrative work is time-consuming and prone to errors. Streamline your workload by automating repetitive processes, ensuring nothing slips through the cracks and giving your team more time to focus on collecting funds.

- Create a centralized data repository – When all your data relating to invoices is in one place, it’s easy for team members to access information and stay on top of collections processes without backtracking or overlapping.

- Implement electronic communication processes – Don’t wait days to get a reply from clients or even team members. Set up efficient communication processes so both you and your customers are always up to date and on the same page.

Automated A/R collection platforms can give your team everything they need to improve your collections effectiveness index. Gaviti offers a comprehensive solution for managing invoices, tracking communications, and automating your collections processes. You can realize the benefits a strong collections effectiveness index can bring to your business.

To improve your CEI, contact the experts at Gaviti for a free demo of our A/R collections platform today.