Effective accounts receivable management is one of the most critical aspects of boosting steady cash flow for your business. With this goal in mind, the A/R team must proactively identify any issues with cash flow and seek long-term solutions before they spiral out of control.

Although every business faces different challenges based on industry, business size, geographical location, and company culture, here are a few typical accounts receivable management problems and solutions your businesses should be aware of.

1. A Poor Vetting Process for New Customers

When you onboard new customers and/or extend credit, you do so because you can reasonably expect to get paid money eventually. Failure to properly vet customers opens the door to delayed payments, bad debts, write-offs, and legal consequences.

To make matters worse, bad debtors often take on as much credit as possible without considering their repayment ability. They may also have outstanding bills from previous creditors that could get prioritized ahead of yours. There’s no way to proactively defend against this without credit monitoring of potential customers.

Solution: Carefully evaluate the creditworthiness of each new customer. This usually involves a credit application or approval process that verifies the customer’s credit history with external credit agencies. New tools also leverage AI tools to help gather this information more quickly and analyze data generated throughout the accounts receivable process to make predictions about future behavior of similar customers. These tools also analyze the data and offer the ability to adjust credit in real-time to customers who pose less of a credit risk and less (or none at all) to those who pose a greater risk of bad debt.

2. Using Legacy Systems That Create Data Silos

Legacy systems typically involve several moving pieces that rarely interact. For example, A/R teams might use one system for invoicing and another for inventory management, but those two systems do not integrate with one another. That creates two groups of data that operate at different levels of accuracy based on who updates them and when. Redundancy also becomes a problem.

Solution: Invest in accounts receivable automation technology that integrates well with your current financial systems (e.g., CRMs, accounting software, ERPs) you use now and plan to use later. Start by analyzing your current infrastructure, identifying any inadequacies and need for potential upgrades. Then, choose accounts receivable solutions that meet your short-term needs and long-term goals.

3. Managing the Accounts Receivable Process Manually

Manual processes can create even more accounts receivable challenges. They often involve tedious tasks, such as data entry, that are prone to error. One survey found that 98% of respondents had witnessed errors that were severe enough to cost the company money. These human errors lead to poor customer service experience such as losing track of payments, delayed and slow payment cycles.

Solution: Automation eliminates human error involved in repetitive tasks, increasing the accuracy of information entered into the system and allowing employees to focus on higher-value tasks with accurate data in hand. Centralizing information also makes it easier for A/R teams to analyze and access this data whenever needed, in addition to analyzing trends and patterns and forecast future cash flows. Automating your cash application also ensures more accurate and quicker matching of payments to invoices, facilitating a better customer experience and cash flow management.

Tackle your most pressing A/R challenges

Accounts receivable software not reduces time spent on manual processes, but it also provides managers more control and predictable results in the A/R function. Schedule a demo to see how this is done and if Gaviti is right for your company.

Schedule a Product Demo4. Not Providing Adequate Payment Options

Payment friction will delay payment. The more difficult it is for a customer to settle the invoice, the more likely they are to procrastinate and prioritize other invoices that involve less friction. For example, newer companies prefer electronic methods for settling a bill, but older companies might still have systems for sending a check. The longer the settling of an invoice is put off, the less likely it is to happen.

Solution: Customers are more likely to pay when you reduce friction in the collection of accounts receivable. Supporting several payment methods that match their internal processes is crucial to delivering good customer experience and making it available in one place (i.e. a payment portal) is even betterThe accounts receivable process and payment preferences vary across businesses, so the more options you can reasonably support, the better. Standard options include money orders, checks, ACH, credit cards, and cash. Multi-payment gateways enable these payment methods and also support multiple currencies, intelligence transaction routing, and the ability to mitigate any operational downtime. They can also integrate with customer payment portals that allow customers to pay 24-7 with a variety of payment options, and minimize the possibility of a payment error.

5. Inconsistent Invoicing and Collections Processes

Inconsistency is more likely when companies rely on manual processes. For example, workers may manage calendars for sending out invoices to customers and might even manually prepare each one. What happens if they don’t complete the process in time and the invoices go out late? What if a worker forgets and a few invoices fall through the cracks? If you have multiple collectors, for sure you are going to have inconsistencies because people have different logic and communication styles. Plus their properties might not be completely aligned with the company’s priorities. Not having a communication template is another form of inconsistency that can hamper the collections process.

Solution: Establish an invoicing and collections workflow and use automation to execute it. Use software that automatically sends out invoices on the same time intervals for customers and sends out reminders before due dates. You should be able to streamline the process by altering collections email templates and sending them to customers at different stages of the collections process. An accounts receivable automation solution that offers personalization also ensures that the message addresses the customer specifically and has been proven to lead to better outcomes. You can also segment if you have different groups of customers with different needs.

6. Disregarding Relationships With Late-Paying Customers

Most customers who pay late are not doing so out of malice. Sometimes, companies take unexpected financial hits that ripple throughout the organization. The company could have recently paid a lawsuit, or its customers might not have settled their invoices. Economic hardships might also directly impact their industry while leaving others unscathed. These types of late payers could become loyal customers if you play a supportive role while they get back on track.

Solution: First, you must ensure the customer is aware of the overdue invoice and communicate it by sending an overdue invoice letter. There is always a possibility that the customer is late on their invoice due to a miscommunication or dispute about payment. Or the customer may not be able to easily pay via the payment methods currently offered.

Once the overdue invoice is acknowledged, however, you’ll want to work with your customer as much as possible by agreeing on modified payment terms that you can both live with. You may also need to escalate collections with collections calls and internal processes defined by your A/R team.

7. Inadequately Trained Workers

Your accounts receivable workers might not have the right skills to manage their duties. Even if they initially entered their roles with the right skill sets, technological changes in automation, data analytics, artificial intelligence (AI), and increased reliance on cloud platforms due to the volume of data have all brought rapid change to the industry.

Solution: Identify the skills your workers need to improve and master. Create training programs specifically for A/R employees such as exploring different A/R strategies that align with overall business strategy, establishing accelerated receivables management, identifying challenges or bottlenecks in your A/R process, and escalating the collections process while maintaining good customer relationships. Educate them as to how AI, automation, and autonomous finance have changed the industry, A/R teams in general, and how it relates to their A/R process specifically. In addition, accounts receivable automation software also comes with its own learning curve, but you can help your workers by choosing one that is intuitive, easy to learn, and has good customer support.

8. Slow Resolution of Disputes with Customers

The traditional process of dispute management is a manual process with many steps which often involve additional rounds of approvals. Although it requires collaboration between different departments in your business, it usually offers limited visibility, with data and information that is not regularly updated. It also consumes human resources that could be better spent on higher value tasks. These disputes can lead to late payments, frustrated customers, and put a dent in your cash flow.

Solution: Make sure all invoices include accurate and important details about the product or services paid for such as the date, amount paid, your address and name of the organization, etc. It should also include all past invoices. Send an estimate before the agreement is in place and send an agreement immediately once a purchase is made. Finally, automating and streamlining the dispute process puts all of the information in one place to help ensure more efficient dispute management. Many disputes can be resolved immediately with the right tools and information, but you need software that supports that.

How Gaviti Addresses Top Accounts Receivable Challenges

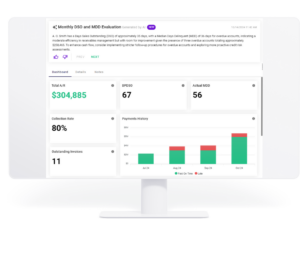

While automated A/R solutions help you overcome the challenges above by streamlining these processes and eliminating human error, autonomous A/R solutions take things a step further, enabling tasks to be completed on their own without constant human intervention or control. Gaviti is the only autonomous invoice-to-cash A/R management platform on the market today that has proven experience reducing DSO by up to 55% and late receivables by up to 50%.

Its modules include:

- Credit Management. Onboard new clients faster and with less risk with an AI pilot that gathers data and information and makes suggestions about which customers pose less risk. Simplify the credit workflow with online credit applications, credit request forms, and pro-active flagging of risky clients.

- A/R Collections Management. Automate and streamline the collections process, including reminders, internal or external escalations and intelligently prioritize collections to focus on high value clients, accelerating cash flows and minimizing bad debt.

- A/R Analytics. Gain a holistic view of your KPIs and metrics related to your A/R efforts, both as a team and individual employees. Analyze collections performance over time, identify bottlenecks in the process, and implement targeted improvements.

- Dispute Management. Resolve disputes in an hour with clear instructions for your customer and fully customizable workflows for routing and tracking to see trends and reduce future disputes. All alerts and communications are communicated in real-time so they can be dealt with immediately.

- Cash Application. Get AI-powered remittance auto-matching and remittance portal automation to reduce errors in the payment process and avoid disputes.

- Customer Self Service Portal. Allow customers easy access to outstanding invoices in one place and easy engagement with your A/R team to solve requests independently. Offer multiple payment options along with an auto payment option for convenient payment 24-7.

Want to learn more about how Gaviti’s autonomous invoice-to-cash A/R management platform can help you solve your A/R challenges? Schedule a demo today!