Credit Management and Monitoring: Mitigate Credit Risk, Strengthen Financial Health

Gaviti provides a comprehensive platform that leverages both external and internal data to alert collections teams about the credit risk posed by existing customers. By proactively monitoring credit and allowing you to make credit searches, you can make informed decisions and take necessary actions to mitigate risk.

Schedule a Demo

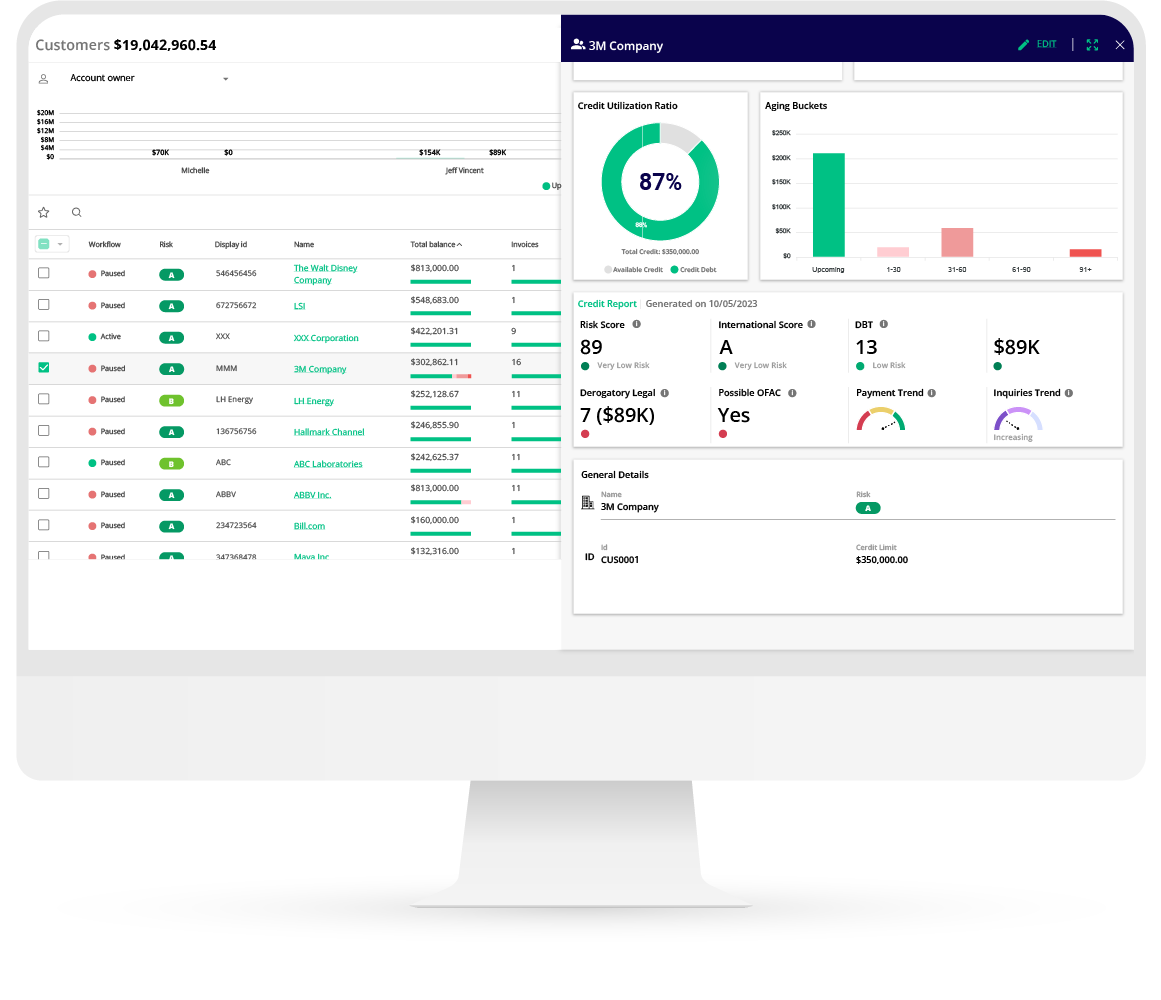

External and Internal Data Integration

Gaviti integrates with external data sources, such as credit ratings agencies and other reputable sources, to gather information on the creditworthiness of your customers. Plus, you can set up real-time alerts when there are changes to your customers’ credit reports. By leveraging this data, our platform provides you with valuable insights into the financial stability and credit risk associated with each customer. Stay informed about changes in credit ratings, financial health, or other factors that may impact credit risk.

Simple Credit Application to Customers and Prospects

Gaviti empowers you to send credit applications to both existing customers and potential prospects, streamlining the entire credit application process from form submission to approval and ongoing monitoring. Plus, the approval process and credit limit settings can be automated, ensuring company policy and followed every time.

Real-time Credit Risk Alerts

Gaviti’s Credit Management and Monitoring solution alerts collections teams in real-time about customers with increased credit risk. These alerts can be triggered based on predefined thresholds or specific criteria, allowing you to prioritize collections efforts and address potential issues promptly. By staying ahead of credit risk, you can minimize the impact on your cash flow and reduce the likelihood of bad debt.

Credit Limit Management & Monitoring

Gaviti allows you to define and manage credit limits for your customers. By setting credit limits based on creditworthiness and risk assessment, you can proactively monitor and control exposure to potential credit risks. Our solution provides visibility into credit limits, utilization, and available credit, empowering you to make informed decisions when extending credit or modifying credit terms.

Customizable Risk Assessment Criteria

Every business has unique risk assessment criteria. Gaviti’s platform enables you to customize and define the criteria that align with your specific business needs. Whether it’s defining payment behavior thresholds, credit score ranges, or other risk factors, our solution allows you to tailor the risk assessment process to your requirements, ensuring a targeted and effective credit management strategy.

Reporting and Analytics

Gaviti offers comprehensive reporting and analytics capabilities to gain insights into credit risk trends, customer profiles, and overall credit management performance. Track key metrics such as DSO (Days Sales Outstanding), credit risk exposure, and credit utilization. By leveraging these insights, you can continuously improve your credit management strategy, optimize credit decisions, and drive financial success.

With Gaviti you can proactively monitor credit risk, assess customer creditworthiness, and take timely actions to mitigate risk. By leveraging external and internal data, collaborating across teams, and customizing risk assessment criteria, you strengthen your financial health and enhance decision-making.

Take the first step towards transforming your A/R collections process and Schedule a Demo