As financial teams strive to become more agile and data-driven, AI agents in cash flow management are redefining how organizations manage liquidity, forecast performance, and maintain financial health. The rapid rise of automation and artificial intelligence in finance has opened new doors for real-time decision-making and operational efficiency.

The All-In Podcast and others have said that an AI agent is like having a all-knowing, all-seeing Ph.d intern working for you 24/7. They see issues and offer suggested fixes around the clock.

This article explores how businesses can harness AI-driven cash flow forecasting and implement real-time cash flow management software to stay competitive. We’ll break down the role of AI agents, explain their benefits, walk through implementation steps, and address key questions CFOs and finance leaders often ask.

The Growing Role of AI Agents in Cash Flow Management

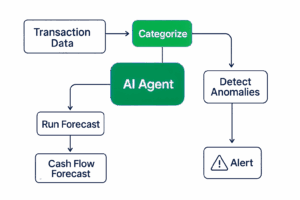

AI agents in cash flow management are intelligent, autonomous systems designed to continuously analyze financial data, detect anomalies, and generate accurate forecasts in real time. These digital assistants are transforming finance departments by moving cash flow processes from reactive to proactive.

Traditionally, cash flow management relied on periodic reports and manual data aggregation, often leading to outdated insights. AI agents, on the other hand, ingest real-time inputs from multiple data sources, such as ERP systems, bank feeds, invoicing software, and customer payment behavior, to deliver up-to-the-minute analysis.

What sets them apart is their ability to learn and adapt over time. Unlike static rules-based systems, AI agents evolve with new data trends, enabling more nuanced forecasting that aligns with the business’s current environment.

These AI tools are especially valuable in managing the cash flow cycle, from receivables to payables, by identifying bottlenecks, optimizing payment timing, and ensuring companies never run dry on working capital.

How AI-Driven Cash Flow Forecasting Enhances Decision-Making

At the heart of AI-powered financial tools is their ability to improve forecasting. Cash flow forecasting is critical for planning, yet often riddled with inaccuracies due to fragmented data and human error.

AI-driven cash flow forecasting solves this by:

- Consolidating multi-source data – AI pulls from invoices, payroll, CRM, and banking data to present a unified financial picture.

- Detecting anomalies in real time – These systems flag abnormal spikes or dips in cash activity, allowing proactive intervention.

- Enhancing scenario planning – AI simulates multiple “what-if” scenarios to help teams evaluate the impact of business decisions on liquidity.

- Bridging short-term vs. long-term forecasting – While many businesses struggle to balance short term vs. long term cash flow forecasting, AI tools allow granular insights at both strategic and operational levels.

As a result, finance teams move from reacting to past results to forecasting future cash positions with high confidence. This significantly improves decision-making in areas like capital investment, hiring, and vendor negotiations.

Key Benefits of Implementing Real-Time Cash Flow Management Software

Using real-time cash flow management software offers a range of strategic and operational benefits:

1. Enhanced Liquidity Monitoring

AI tools give businesses a dynamic dashboard of liquidity levels, automatically updating as data changes. This ensures no surprises, even during volatile market conditions.

2. Faster Cash Conversion Cycles

With AI helping streamline billing, collections, and payments, companies reduce the time it takes to turn sales into cash, optimizing the cash flow cycle.

3. Lower Financial Risk

Real-time insights reduce the risk of overdrafts, missed payments, or default due to poor forecasting. AI also flags risks associated with customer non-payment or external economic trends.

🚀 See AI in Action: Real-Time Cash Flow, Solved.

Curious how AI agents actually drive results in finance teams? Don’t just read about it — watch the Gaviti demo to see real-time cash flow management in motion. From proactive collections to intelligent prioritization, it’s what modern AR looks like.

👉 Click to watch and transform your cash flow strategy.

Watch the Product Demo4. Better Alignment Across Teams

When A/R, treasury, accounting, and sales all have access to real-time cash data, alignment improves. Shared dashboards ensure everyone is working from the same financial reality.

5. Data-Driven KPI Tracking

Modern AI platforms help track cash flow KPIs such as Days Sales Outstanding (DSO), collections efficiency, and forecast accuracy, ensuring that finance leaders have measurable benchmarks.

6. Scalable Automation

As your business grows, AI scales with you, handling higher data volumes and complexity without increased headcount or burnout.

These features make real-time cash flow management software one of the best cash flow management tools available to modern finance teams seeking visibility and control.

Steps to Successfully Integrate AI Agents into Your Cash Flow Strategy

Implementing AI agents isn’t just a tech upgrade, it’s a strategic transformation. Here’s a step-by-step approach to integrating AI into your cash flow processes:

Step 1: Audit Your Current Cash Flow Processes

Before deploying AI, map out how your cash flow is currently managed. Identify data silos, manual bottlenecks, and reporting lags. This audit lays the foundation for automation. Machines are great, but they will be more useful if you give them meaningful direction.

Step 2: Define Objectives and KPIs

Be clear about what you want to achieve, whether it’s reducing DSO, improving forecast accuracy, or enabling better working capital allocation. Align these with measurable cash flow KPIs.

Step 3: Select the Right Software

Choose real-time cash flow management software that supports AI-driven automation, multi-source data integration, and customizable dashboards. Opt for tools with a track record of success in your industry segment. Also be sure to ask if the tools update data from sources inside and outside the tool in real time. AI is only as accurate as the information it is given.

Step 4: Ensure Data Integration

Connect your ERP, CRM, bank feeds, A/R/A/P platforms, and payroll systems. The more comprehensive the data inputs, the smarter your AI becomes.

Step 5: Train Your AI Agents

AI tools often require an onboarding period where the system learns from your historical data. Monitor how the agent performs during early stages and calibrate based on feedback loops.

Step 6: Pilot and Monitor Performance

Begin with a specific cash management function, like short-term cash forecasting or collections optimization. Evaluate outcomes, then scale across more workflows.

Step 7: Build a Culture of Continuous Improvement

AI performance improves with time and input. Encourage your team to refine AI outputs, correct anomalies, and feed the system richer data. This creates a virtuous cycle of optimization.

Frequently Asked Questions What are AI agents in cash flow management?

AI agents in cash flow management are digital systems that use machine learning and real-time data to automate tasks like forecasting, anomaly detection, and liquidity tracking. They enhance decision-making by delivering accurate, continuously updated financial insights.

How do AI-driven tools improve real-time cash management?

AI-driven tools analyze transactional data as it happens, enabling immediate visibility into cash positions, upcoming risks, and payment behaviors. They allow businesses to react faster and plan better, improving liquidity control and reducing surprises.

What should businesses consider when choosing real-time cash flow software?

Look for platforms that offer AI-driven forecasting, seamless data integration, real-time dashboards, and scalability. Also, ensure the tool supports your industry needs, aligns with your KPIs, and provides actionable insights, not just data dumps.

Can AI-driven forecasting reduce financial risk for businesses?

Yes. By detecting payment delays, identifying cash gaps, and enabling proactive adjustments, AI-driven forecasting significantly reduces financial risks. These tools offer early warnings and simulation features that help finance teams plan with confidence.

Are AI agents suitable for medium-sized enterprises?

Absolutely. Many AI platforms are scalable and designed to fit mid-sized firms. With proper implementation, AI agents provide medium businesses with enterprise-grade cash visibility, improved forecasting, and efficiency gains, without needing a massive IT investment.

How Gaviti’s AI Co-Pilot Helps With Cash Flow Management

Gaviti is a leading accounts receivable automation platform designed to help businesses accelerate and optimize their A/R processes. Built with finance teams in mind, Gaviti empowers organizations to streamline operations, improve cash flow visibility, and reduce DSO (Days Sales Outstanding). At the heart of this transformation is Gaviti’s AI Co-Pilot, an intelligent assistant that enhances every step of the AR lifecycle.

By harnessing the power of AI, Gaviti automates and augments the critical functions of collections, credit management, dispute resolution, and cash application. The result is faster processes, fewer errors, and better cash flow predictability, all in a single, integrated platform.

How Gaviti uses AI to help businesses manage cash flow more effectively:

- Smart A/R Workflows: AI-driven strategies prioritize accounts based on risk and payment behavior, ensuring teams focus efforts where it matters most.

- Credit Risk Insights: Gaviti uses real-time data to help assess customer creditworthiness, minimizing exposure to bad debt.

- Dispute Management Automation: The AI Co-Pilot helps track, categorize, and resolve disputes quickly, reducing delays in the cash flow cycle.

- Automated Cash Application: Match payments to invoices faster with AI-enhanced matching logic that reduces manual intervention and speeds up reconciliations.

- Predictive Forecasting: Leverage AI to enhance cash flow forecasting accuracy, allowing better planning and short-term liquidity decisions.

- Personalized Engagement: Use machine learning insights to send the right message to the right customer at the right time, improving collection outcomes.

Gaviti’s AI Co-Pilot isn’t just a feature, it’s a financial teammate that enables smarter, more strategic decision-making. Whether you’re a mid-sized business or a growing enterprise, our solution adapts to your needs and helps you manage cash flow with confidence.

Ready to see how Gaviti can transform your A/R process? Book a personalized demo today and discover the power of AI in action.