Gaviti is excited to announce the release of a brand new update, packed with new features and improvements designed to help our users better manage their accounts and improve their collections efforts. With this update, we’ve added new insights, enhanced the AR team screen, added partial payment functionality, and introduced a host of new metrics to the dashboard. We believe these new features will be invaluable for our users and we can’t wait for you to try them out. Keep reading to learn more about what’s included in this update.

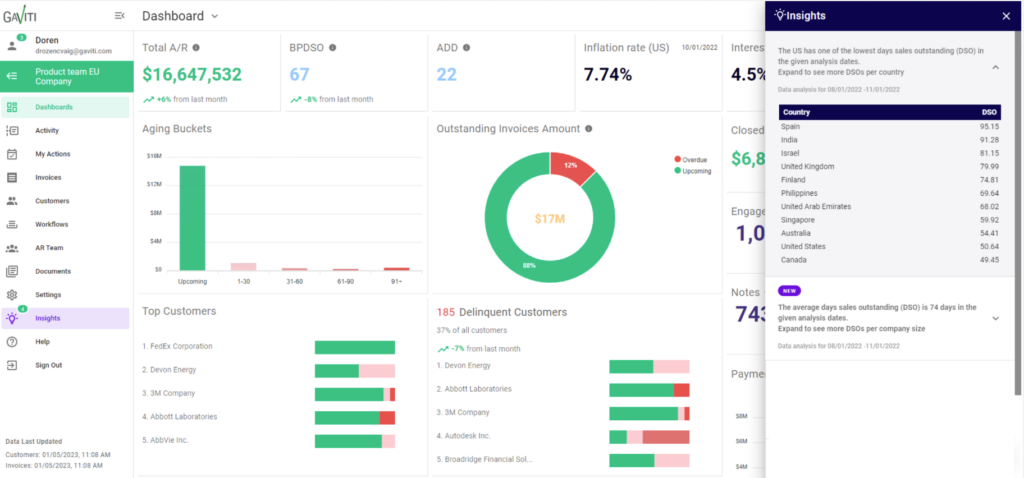

Get valuable DSO comparison data with – Insights.

Let’s start with: Insights!

The Insights section provides valuable information on DSO (days sales outstanding) and allows users to compare their collections team’s performance to similar companies. With the addition of two new insights – benchmark DSO per country and benchmark DSO per company size – users can gain a deeper understanding of how their team stacks up against others.

This new feature is all about improving the user experience and helping Gaviti users make informed decisions about their collections strategies.

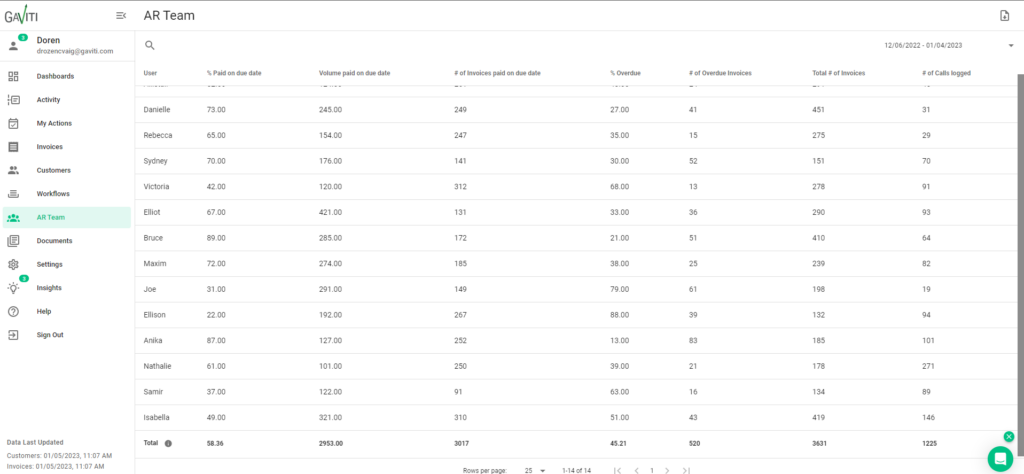

New A/R Team Screen provides a comprehensive view of team performance

The next addition to Gaviti is the A/R team screen. This feature was specifically requested by our customers and we are thrilled to be able to deliver it.

The A/R team screen presents relevant KPIs for each user, giving controllers, AR managers, and VP of finance a full picture of their team’s performance. The added option to change the view for different time frames allows users to customize their experience and get the information they need in a way that works best for them.

We believe this new feature will be invaluable for those looking to get a comprehensive overview of their AR team’s performance.

Partial Payment Feature Boosts Collections Rate and Improves Cash Flow

Many of our customers have reported that they love the partial payment feature. We are adding some new functionality to make it even more useful. Gaviti customers can now decide if they wish to enable or disable partial payments for each customer. No need to have the same partial payment option across the board. In addition, once a partial payment is made, the amount due will be updated automatically on the invoice in Gaviti’s payment assistant. The addition of partial payment options can help increase your collections rate and improve cash flow. By giving customers the ability to make partial payments, you may be able to close more deals and get paid faster.

We believe this new feature will be a valuable addition to your customers.

Tagging Functionality Makes Customer and Invoice Management Easier

Managing your customers and invoices has never been easier with the addition of tagging functionality. This new feature allows users to tag customers and invoices, making it easier to manage and organize your accounts in the way you see it.

With the ability to export tags for customers and invoices, you can easily share this information with your team. And with the ability to filter customers and invoices by tags, you can quickly find the accounts you are looking for.

We believe this new feature will help users easily manage their customers and invoices based on custom tags. We hope you find it useful in your collections efforts.

New Dashboard Metrics Provide Enhanced Insights into Collection Efforts

For your convenience we added several new metrics to the Gaviti dashboard. These new KPIs (key performance indicators) will help users get a deeper understanding of their accounts and make informed decisions about their collections strategies.

- First, we’ve added the BPDSO (Best Possible Days Sales Outstanding) metric to the dashboard. This KPI is calculated by dividing the current accounts receivable by billed revenue and multiplying that number by the number of days.

- Next, we’ve added the ADD (Average Days Delinquent) metric to the dashboard. This KPI measures the number of days that a payment is overdue, calculated by subtracting the BPDSO from the DSO (Days Sales Outstanding).

- We’ve also added the inflation rate and interest rate to the dashboard, pulling this data from an API (available only for the USA). These metrics will help users understand the economic factors that may be impacting their accounts.

- Finally, we’ve added the MDD (Median Days Delinquent) metric to the dashboard. This KPI, developed by our team, measures the median number of days between the due date and the actual payment date for all late payments. This metric is based on actual customer data and will give users a deeper understanding of their accounts’ payment patterns.

For further understanding these new KPIs please check out the dedicated blog post.

Coming Soon: Features to Enhance Collection Efforts and Manage Customer Risk

We are constantly working to improve Gaviti and are excited to we working to include these features in upcoming releases:

- First, we will be adding a collection rate metric to help our customers track the effectiveness of their collection team in recovering outstanding debts.

- We will also be adding a terms of payment metric, which measures the distribution of invoices per payment terms. This will be presented as a pie chart based on customer data and will give users a better understanding of their payment patterns.

- In addition, we will be adding a payment gateways metric to measure the amount of money collected through Gaviti’s gateway (Bluesnap). This will give users a clear picture of their payment activity.

- Finally, we will be adding a customer risk metric, which measures the distribution of payers by risk level. This will help users make informed decisions about managing their company’s finances, diversifying their customer base, and managing overall risk exposure. It will also allow users to focus on challenging customers.

- Stay tuned for even more updates!

If you are an existing Gaviti user and want to learn more about these new and upcoming features, please don’t hesitate to reach out to your customer success manager for more information and assistance in accessing them. If you are not yet a Gaviti customer and are interested in learning how our platform can help streamline your invoice-to-cash flow process, please don’t hesitate to contact us.